Insights to the tastiest bits…

RBA keeps cash rate on hold at 3.60% in November

The RBA kept the cash rate at 3.60%. Inflation has come down a lot since 2022, but the latest quarterly figure was higher than they expected. Part of that was due to one-off factors like electricity rebates ending, but it also shows price pressures aren’t completely gone.

At the same time, the economy is picking up again – spending is improving, housing is stronger, and the labour market is still reasonably solid.

There are also uncertainties around demand and supply in the economy, the jobs market, and productivity. These could push inflation or employment in either direction.

Because of that, the RBA decided to stay cautious and leave the cash rate unchanged.

November 2025

Great news! The RBA has cut the cash rate to 3.6% for August

The Reserve Bank has reduced the cash rate by 0.25% at its August meeting – the 3rd cut this year, following reductions in February and May. This brings the cash rate down to 3.60%, the lowest level since April 2023.

With inflation easing in the June quarter, today’s move was widely anticipated. If your bank passes on the cut in full, your variable home loan repayments will go down. It can also mean sharper offers for new lending and an increased borrowing capacity.

August 2025

Which Capital Cities Have Delivered the Best Long-Term Growth?

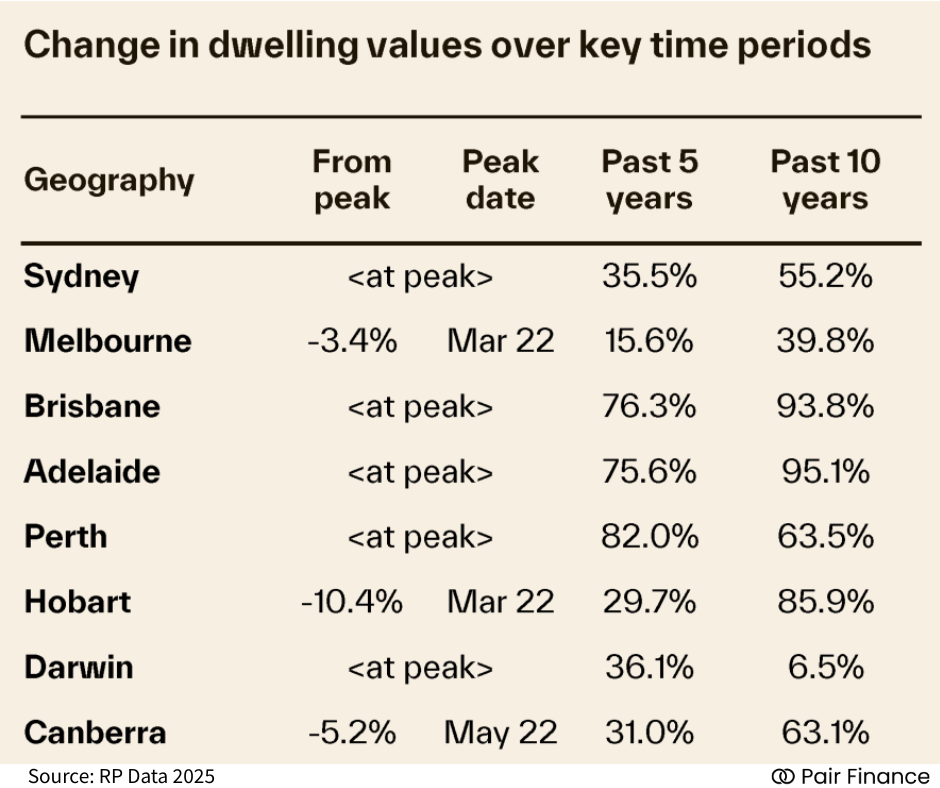

While Sydney and Melbourne have historically led property booms, their returns over the past 5 and 10 years now trail behind several smaller capitals.

Adelaide and Brisbane emerge as the standout performers. Over the past 5 years, both have seen values rise over 75%, and over 10 years they’ve delivered remarkable total growth of 95.1% and 93.8%, respectively. These markets have shown consistent, long-term strength and resilience.

Perth has delivered the strongest 5-year growth (82%), but over 10 years its return (63.5%) lags behind Adelaide, Brisbane, and even Hobart. Investors may find its recent momentum attractive, but the long-term picture is more modest.

Hobart saw a surge earlier in the decade, with 85.9% growth over 10 years, but recent performance has slowed (29.7% in 5 years), suggesting it may have already passed its peak cycle and could be in a consolidation phase.

Sydney and Melbourne, despite their size and stability, now sit mid-pack for long-term returns. Sydney’s 5- and 10-year growth stands at 35.5% and 55.2%, while Melbourne trails further at 15.6% and 39.8%.

Darwin and Canberra offer mixed signals. Darwin is at its peak and delivered a solid 36.1% 5-year return, but its 10-year growth is just 6.5%, the lowest of all capitals. Canberra, meanwhile, shows more balanced returns with 31% over 5 years and 63.1% over 10.

Insights

If you’re looking for both recent momentum and solid long-term performance, Adelaide and Brisbane remain the top contenders. They’ve not only grown fast - they’ve stayed strong across a full market cycle.

August 2025

House Prices Rise Across All Capitals – Year Ending July 2025

Sydney’s property market remains steady but subdued, with dwelling values rising 0.6% over the past month and 1.6% over the year. Despite the modest growth, Sydney retains the highest median value in the country at $1,228,435, reflecting its status as a premium market. In contrast, cities like Darwin, Brisbane, Adelaide, and Perth have seen stronger momentum. Darwin led the growth with an 8.5% annual increase and a 15.8% total return, even though it has the lowest median value at $549,371. Brisbane and Adelaide followed closely with annual gains above 7% and strong total returns above 10%. Meanwhile, Melbourne, Hobart, and Canberra have remained relatively flat, with annual growth rates between 0.5% and 1.9%.

August 2025

Brisbane cracks the million-dollar club

Brisbane cracks the million-dollar club, officially becoming Australia’s second most expensive capital city for houses, with the median price hitting $1.011 million in Jun — just behind Sydney’s $1.497 million. This milestone has been years in the making, driven by strong demand, limited housing supply, and record levels of interstate migration.

🔑 For investors, Brisbane presents compelling fundamentals:

9.2% population growth since 2020 (well above the national average of 6%).

Housing supply not keeping up with demand (88,000 built vs 94,000)

Low vacancy rates and high rental demand

Migration and job growth

July 2025